- #Optimization real life examples calculus how to

- #Optimization real life examples calculus install

These cannot be seriously studied without multivariate Calculus. But even linear optimization benefits from Calculus (the derivative of the objective function is absolutely important)

Optimization, non-linear mostly, where multivariate Calculus is the fundamental language used to develop everything. But you'll need Calculus here even for very basic things: try searching for "Fourier Transform" or "Wavelets", for example - these are two very fundamental tools for people working with images.  Computer Graphics/Image Processing, and here you will also need Analytic Geometry and Linear Algebra, heavily! If you go down this path, you may also want to study some Differential Geometry (which has multivariate Calculus as a minimum prerequisite). I have used bold face for the usually obligatory disciplines for a Computer Science degree, and italics for the usually optional ones.

Computer Graphics/Image Processing, and here you will also need Analytic Geometry and Linear Algebra, heavily! If you go down this path, you may also want to study some Differential Geometry (which has multivariate Calculus as a minimum prerequisite). I have used bold face for the usually obligatory disciplines for a Computer Science degree, and italics for the usually optional ones. #Optimization real life examples calculus how to

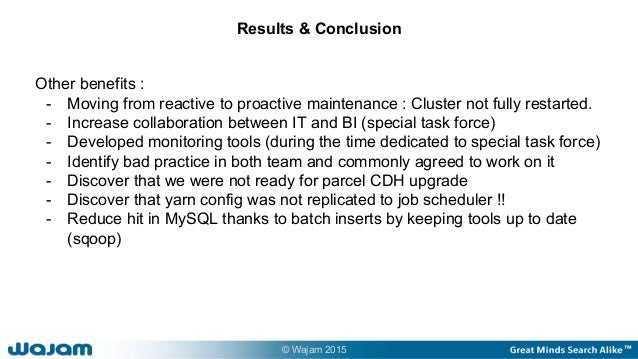

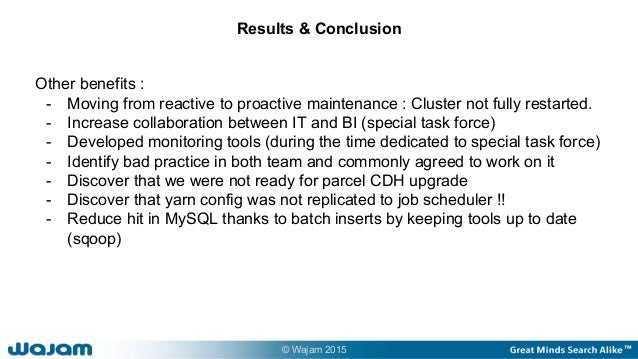

Cutting Stock: Determine how to cut larger pieces of wood, steel, etc.I can think of a few courses that would need Calculus, directly. Process Selection - Decide which of several processes (with different speeds, costs, etc.) should be used to make a desired quantity of product in a certain amount of time, at minimum cost. Blending: Determine which raw materials from different sources to blend to produce a substance with certain desired qualities at minimum cost. Machine Allocation: Allocate production of a product to different machines, with different capacities, startup cost and operating cost, to meet production target at minimum cost. Product Mix: Determine how many products of each type to assemble from certain parts to maximize profits while not exceeding available parts inventory. Bond Portfolio Exact Matching: Allocate funds to bonds to maximize portfolio return while ensuring that periodic liabilities are met - with or without reinvestment. Bond Portfolio Management: Allocate funds to bonds to maximize return while ensuring that the portfolio duration equals the investment horizon for maturity - with known or computed durations. Portfolio Optimization - Sharpe Model (CAPM): Uses Excel's regression functions to calculate alphas and betas for stocks relative to a market index, then uses these to find an efficient portfolio. Stock Portfolio Management: Uses a VBA macro to optimize several scenarios for minimum risk at different target rates of return, then draws a graph of the efficient frontier. Portfolio Optimization - Markowitz Model: Allocate funds to stocks to minimize risk for a target rate of return - with known or computed variances and covariances. Capacity Planning: Determine which plants should be opened or closed. Cash Management: Determine where to locate lockboxes to minimize the "float" or interest lost to due mailing delays.

Inventory Management: Compare inventory stocking and reordering policies with the EOQ (Economic Order Quantity) model.

Capital Budgeting: Choose a combination of capital projects to maximize overall NPV (Net Present Value).Working Capital Management: Invest in 1-month, 3-month, and 6-month CDs to maximize interest while meeting cash requirements.Examples by Functional Area Corporate Finance You can do this any time after signing up.

#Optimization real life examples calculus install

When you download and install a free trial of our enhanced Solvers for desktop Microsoft Excel, you'll find that more than ninety (90) small, but fully functional, example models are available for your use - covering conventional optimization, simulation and risk analysis, decision analysis (using decision trees), simulation optimization, stochastic optimization, and robust optimization. You can run all of these models with the basic Excel Solver. Here is a comprehensive list of example models that you will have access to once you login. To learn more, sign up to view selected examples online by functional area or industry. Optimization is a tool with applications across many industries and functional areas.

0 kommentar(er)

0 kommentar(er)